Just six month after raising its first bit of outside funding, ClickUp has closed $100 million in new funding and reached a $1 billion valuation, a report in Bloomberg first reported.

The company has seen plenty of growth in the past several months to justify that new unicorn status, including doubling the amount of users to 2 million. In a press release the company also detailed it had grown revenue nine times over since the beginning of the year.

This latest $100 million round was led by Canadian firm Georgian with participation from Craft Ventures, which led the startup’s $35 million Series A back in June. The high valuation showcases just how eager investors are to find winners in the productivity software space, which has seen massive customer gains as an industry this year, partially as a result of shifting corporate attitudes toward working from home.

ClickUp is aiming to further capitalize as it scales its team and product. The company of 200 has doubled in size since its last raise and is hoping to double again in the next several months, CEO Zeb Evans tells TechCrunch.

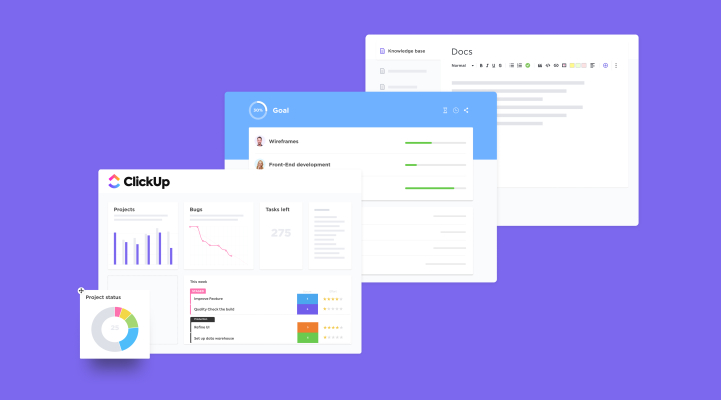

ClickUp sells productivity software, but their main sell has been tying several products in that space into a single platform, aiming to reduce the number of tools their customers use. The team has recently begun integrating tools like email into their platform so that users can complete workflows inside the product.

“It’s not just like a value play of using one app instead of three or four, it’s an efficiency play by saving so much time and frustration from having all the other different solutions,” Evans tells TechCrunch.

Even as the company continues scaling the product through weekly updates to the company’s apps, including a newly revamped iOS app which launched today (Android launches tomorrow), the team is looking toward how they can build for the long-term.

As to how long this cash will last, Evans isn’t making any promises. “I think this will keep us going for a while, though to be honest with you I would’ve said the same thing with the Series A,” Evans says.